FAQs

Frequently Asked Questions

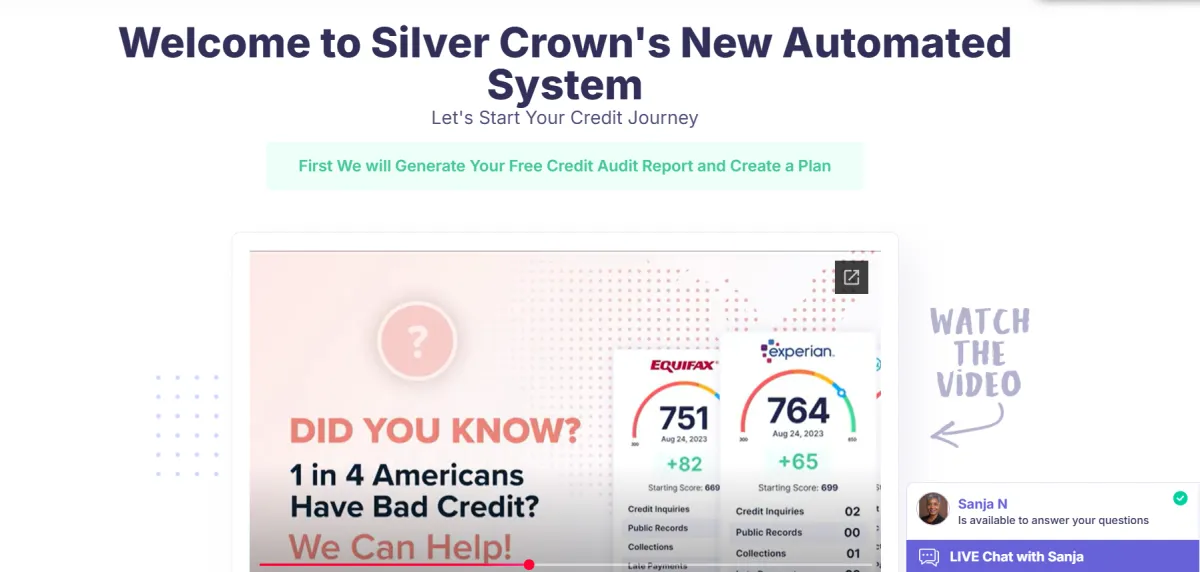

Need more information about our credit repair services? Below you’ll find clear answers about how our process works and how we can also provide personal credit help if you are building or repairing your financial reputation.

What is a consultation?

A consultation is your first step toward better credit health. We review your current credit standing, discuss your goals, and create a personalized plan for personal credit repair services.

What is a Credit Audit?

A credit audit is a detailed review of your reports. We highlight errors, inaccuracies, and opportunities to improve. We also offer personal credit score repair audits to help you qualify for better funding and partnerships.

When Do You Charge Me For The Audit?

We only charge once the audit is complete and delivered to you. This ensures you know exactly what to expect from our credit repair services before making any commitment.

Should I stay enrolled in your monitoring service?

Yes, credit monitoring helps you track changes and protect against errors. Many clients who use monitoring alongside personal credit solutions see faster, long-lasting results.

How long does the process take and when can I expect to see results?

Credit repair takes consistency and patience. Most clients notice improvements within a few months. Our personal credit repair services often bring visible score improvements within 90 days, depending on the starting profile.

What is the cancellation policy?

You can cancel anytime. We believe in results, not locking clients into contracts. With our personal credit help, you’re always in control of the process.

What does the process entail?

Our process is simple: audit, dispute, monitor, and rebuild. We also focus on personal credit repair strategies that strengthen your financial reputation with lenders.

Can you help me build credit?

Absolutely. We don’t just remove errors, we guide you in adding positive accounts that raise your profile. Many individuals come to us specifically to fix personal credit and unlock new growth opportunities.

When will I see results?

Some changes show within 45 days, but full results may take 3 to 6 months. With personal credit help, results often arrive faster since lenders report more frequently on accounts.

What Is Credit Monitoring?

Credit monitoring tracks activity and keeps your information safe. Pairing monitoring with our credit repair services ensures you stay protected while improving scores.

What Is My Credit Score Based On?

Scores are based on payment history, debt ratio, account age, and more. Our personal credit repair services review your accounts to help balance and strengthen your profile.

Can Items Reappear On My Report?

Sometimes items can return if not handled correctly. That’s why our credit repair services use proven dispute methods to ensure permanent removal wherever possible.

What happens to accounts when they are removed?

Removed accounts no longer impact your score. For individuals, this can be the difference between being denied or approved for credit, making personal credit score repair vital.

Is Credit Repair legal?

Yes, credit repair services are fully legal under federal law. We work within the guidelines to protect your rights while improving your financial future.

Is credit repair really worth it?

Definitely. Whether you’re looking for better loan rates personally or aiming to fix personal credit for growth, strong credit unlocks opportunities that can save you thousands of dollars over time.